Cet article a déjà été publié en juillet dans sa version française. Au vu des retours qu’il a suscités, nous en proposons aujourd’hui une version anglaise en direction de notre lectorat anglophone.

What is the purpose of a Sovereign Wealth Fund?

Sovereign Wealth Funds (SWF) have become major players in international finance, as attested by their total assets under management, estimated at USD 9.4 trillion in 2017[1]. Over the last 20 years, the boom of Sovereign Wealth Funds has been compounded by the rise in commodity prices and the increase in balance of payments’ surpluses in certain countries, notably among emerging economies.

Originally, these Funds aimed at smoothing the impact of volatile hydrocarbon prices. Indeed, in the 1970s and 1980s, many exporting countries suffered from the « Dutch disease »: their hydrocarbon export revenues led to an overvaluation of national currencies and a deterioration in the competitiveness of the non-oil sector, leading to a very high vulnerability to fluctuations in commodity prices. It should also be noted that the creation of a Sovereign Wealth Fund has been frequently recommended by the International Monetary Fund (IMF) in its structural adjustment programmes applied to commodity-exporting countries in order to encourage national savings and smooth cyclical fluctuations.

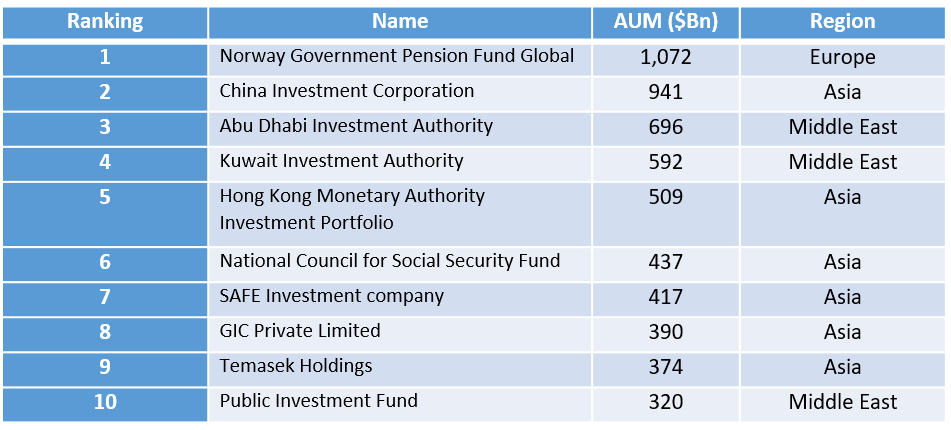

The following table, published by the Sovereign Wealth Fund Institute, provides an estimate of the assets under management of the ten largest Sovereign Wealth Funds. Apart from the Norwegian Fund’s leading position, it shows the pre-eminence of Asian institutions (three Chinese Funds and two Singaporean Funds in the top 10) and Middle Eastern institutions (United Arab Emirates, Kuwait, Saudi Arabia).

There are generally three types of Sovereign Wealth Funds:

- Stabilisation Funds, intended to deal with macroeconomic shocks and a sudden balance of payments crisis, particularly in the case of a sharp fall in commodity prices

- Savings Funds, intended to set aside part of the current surpluses to meet the long-term scarcity of natural resources held; and

- Development Funds, whose main objective is to invest in the local economy to promote its development.

Their different objectives are reflected in very different asset allocations:

- Prudent in the case of Stabilization Funds, which are subject to significant risks of withdrawal in the event of a need for additional resources from their government,

- Largely dominated by global risk assets, equities and alternative assets, in the case of Savings Funds with a very long investment horizon,

- Essentially domestic in the case of Development Funds.

There is now sufficient hindsight to be able to establish a diagnosis of Sovereign Wealth Funds: they play a major role in the management of the revenues and budget surpluses of the countries concerned, and must be governed by clear principles in their management of savings and income distribution. The Norwegian Sovereign Wealth Fund, not only because of its size but also because of its recognised qualities in terms of governance, deserves special analysis in this context.

The Norwegian Sovereign Wealth Fund: precise rules on expenditures and revenue

The Government Pension Fund Global (GPFG) was created in 2006 and replaced the Petroleum Fund, set up in 1990 to manage foreign exchange reserve surpluses from Norwegian oil exports. It is clearly a Savings Funds, and although it does not have an explicit objective of financing future pensions, its name clearly underlines its intergenerational character.

GPFG benefits from (i) taxes and royalties generated by the extraction of oil and gas, (ii) net revenues from the sale on the financial markets of shares in the national oil company Statoil (2), as well as (iii) the returns generated by the Fund above the annual return threshold, initially set at 4 %, transferred to the Norwegian State budget.

The government builds a non-oil budget, which can be in deficit up to a maximum of 4% of the SWF’s assets, 4% corresponding to the expected annual profitability in real terms for the Fund’s portfolio. This 4 % rule represents an implicit short-term commitment for GFPG. It is applied with a certain degree of flexibility since, in the event of very favourable economic conditions, a counter-cyclical budget can be voted, requiring smaller transfers from GFPG. It can also be noted that with the increase in the size of the SWF, the 4% rule gives the government the possibility to set an increasingly higher non-oil budget deficit as a percentage of GDP. Talks were held as early as 2013 to revise this « spending rule », and a reduction from 4% to 3% was finally decided in February 2017.

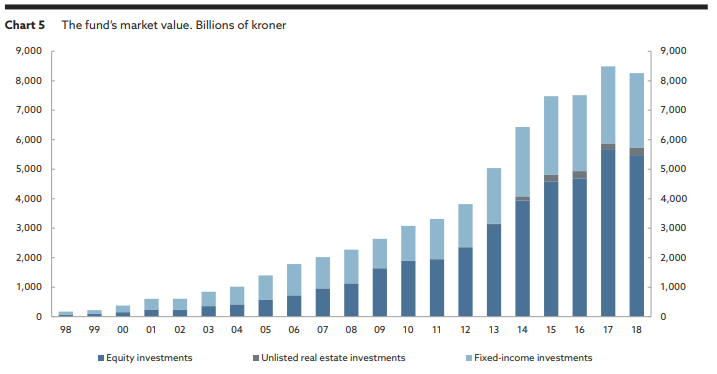

The assets of the Norwegian Sovereign Wealth Fund have grown considerably since its inception. At the end of the first quarter of 2019, they amounted to almost NOK 9 trillion (around EUR 900 billion), compared with NOK 2,845 billion (EUR 285 billion) at the end of 2008, as a result of market developments but also of new resources provided by the government.

A role model in terms of governance

The Norwegian Sovereign Wealth Fund (SWF) is a benchmark for governance, in many regards:

- The separation of powers between the various stakeholders

- Its commitment to transparency[3]

- A consensual approach to decision-making, which limits the influence of changes in government

Each stakeholder has a specific role to play:

- The Minister of Finance plays the role of Fund owner and sets the strategic orientation of the Fund.

- Parliament passes all legislation concerning the Fund, approves its annual budget, appoints the supervisory board and analyses reports on the Fund’s investment guidelines and performance.

- The Executive Committee of the Central Bank acts as the operational manager of the Fund. It is composed of seven members: the Governor of the Central Bank, who acts as Chairman, the Deputy Governor, as Vice-Chairman, and five external members, from the business community, academia or employee representatives. Directors must have a good reputation, with independence of mind, integrity and expertise. The Committee delegates the day-to-day management of the Fund to Norges Bank Investment Management (NBIM), the Central Bank department dedicated to managing the Fund’s assets. Thus, the operational management of the Fund is carried out by an independent public entity. The supervisory board of the Central Bank oversees its activities and reports to Parliament.

- The auditor general is responsible for auditing the Fund’s activity.

The objectives of this organisation are to prevent corruption and the Dutch disease, as well as to ensure rigorous management of public resources. Although there are no absolute rules in terms of governance, it must be said that the objectives of independence, transparency and limiting volatility have so far been well respected by the Norwegian Sovereign Wealth Fund.

The growing importance of equities [4] in the Asset Allocation

The first step in the construction of the GFPG portfolio is to define a benchmark portfolio, with the objective to maximize the risk/return profile within the constraints provided by management. The Fund’s current asset allocation benchmark consists of 70% international equities and 30% international bonds. The weighting of international equities has been gradually increased, from 20% at the outset to 40% in 2002, then 60% in 2007 and 70% in 2017. The geographical structure of equity investments is very close to that of the major international benchmarks (as represented by the FTSE Global All Cap Index), and excludes the domestic market, due to its narrowness in relation to the size of the Fund’s assets and therefore the risk that any allocation movement may be severely destabilising. The structure of the bond portfolio is also international, with a predominance of investments in government bonds, and represented by a benchmark composed of Bloomberg Barclays Global indices. The Fund is therefore mainly exposed to foreign currencies.

A target of 7% allocation of the portfolio to real estate assets had also been set as early as 2007, but the real estate allocation did not begin to be implemented until 2010. The difficulty for an institution with such a high level of assets under management to identify enough attractive investment targets led the Fund to revise its real estate allocation target downwards in early 2019 to a range of 3 to 5% (covering liquid and illiquid real estate assets). At the same time, it was decided to integrate into NBIM the Norges Bank Real Estate Management (NBREM), created to manage real estate assets. This decision was taken with a view to controlling costs, as NBREM had been criticised for its high charges and its excessive focus on « trophy assets » in the form of prestigious international real estate operations.

Evolution of the Fund’s assets under management and structure by asset class

Source: Government Pension Fund Global, Annual Report 2018

In terms of the Fund’s investment policy, the government stated in March 2019 that it would now divest completely from all oil and gas exploration and production companies (which accounted for NOK 66 billion at the end of 2018, or 0.7% of the Fund’s total assets). Such an objective may seem paradoxical for an institution that derives its resources from hydrocarbons, but it reflects both a desire to diversify away from a Norwegian economy that remains dominated by the energy sector, and a genuine commitment by the country to combat climate change. The Norwegian Central Bank was told to step up its efforts to reduce exposure to climate risks [5].

On the other hand, the government impede the GFPG from investing in private equity (unlisted shares) for several reasons: high cost, lack of transparency and the potential impact on the relative risks of the portfolio. Indeed, the investment philosophy of the Fund remains focused on low costs, the largely passive nature of the management (in terms of relative volatility compared to the benchmark) and a very high level of transparency.

Satisfactory performance and controlled risk

With an annualised real return of 3.56% over 20 years and 6.46% over 10 years, the Norwegian SWF is considered to have achieved its objectives. This result was achieved within a controlled risk framework, since the tracking-error, i.e. the volatility of the spread between the portfolio and its benchmark, whose upper bound was set at 1.25%, was only 0.68% over 20 years and 0.56% over 10 years. This modest relative risk-taking did not prevent the Fund from posting a positive relative performance, averaging 25 basis points over 20 years. Risk control also takes the form of an anticipated shortfall constraint of no more than 3.75%, which corresponds to the relative return of the portfolio against its benchmark for the 2.5% of the most negative weeks in terms of performance.

Is the success sustainable?

Thanks to clear rules on expenditure and resources, a very high level of transparency, and good management performance, GFPG is thus considered as a role model to look up to (probably together with the Singaporean GIC Fund and the Chilean Sovereign Wealth Funds). However, one could ask whether this success story will prove sustainable in the long run: has GFPG not become an idol with feet of clay?

So far, its size has not prevented the institution from implementing « contrarian » asset allocation movements, for example by increasing its equity allocation after the 2008 crisis, or again following the sharp market correction at the end of 2018. GFPG has so far benefited from its status as a long-term investor able to seize market opportunities generated by excessive price movements. However, the more its assets under management grow, the greater the risk that its management will become less flexible.

Furthermore, while some SWFs allocate a significant proportion of their assets to real estate, infrastructure or private equity in order to benefit from the illiquidity premium to which their investment horizon entitles them, it has been seen that this was not the case for the Norwegian SWF, due in particular to its difficulty in identifying attractive investment targets.

Another size-related issue is that GFPG now accounts for almost 2% on average of the capitalisation of the companies in which it invests. GFPG’s fiduciary responsibility is therefore important, and requires it to analyse environmental, social and corporate governance issues, especially since its management is scrutinised by the political world, the Norwegian population and financial markets in general: any unfortunate decision could therefore be subject to criticism.

Like any investor, GFPG is facing a low interest rates environment and some gloomy prospects regarding the long-term profitability of equities. As a result, the initial target of an annual return of 4 % in real terms seemed difficult to achieve by maintaining a benchmark allocation of 70 % equities / 30 % bonds. In a very simplified manner, we use the following reasonable assumptions: over the long term, we estimate a 4.5% real return on global equities per annum and 0.5% for bonds. Under these assumptions and based on the current allocation, we obtain an expected return closer to 3 to 3.5% per annum. This justifies the Fund’s decision to reduce its distribution target to 3% and may encourage it to keep increasing its equity exposure, but within the limits mentioned above.

Thanks to the clarity of its governance framework, and probably also of the strong maturity of the Norwegian political and economic environment, GFPG has so far been very successful in avoiding political interference. However, the rejection of the recent proposal to make it an independent entity shows that there is a debate in the country on the degree of independence of the institution. After this government decision Knut Kjaer, who managed the Fund from 1998 to 2007, recently came out of a long silence[6] to express his fears of an excessive politicisation of the Fund’s management, and to stress that it is not the role of a Central Bank to manage such a complex Fund.

It is also questionable whether the success of the Norwegian Fund is not simply a reflection of the quality of the consensual democratic system and the stability of the Norwegian economy. In other words, the organizational model of the Norwegian Fund seems difficult to apply to other Funds in countries that do not benefit from the same institutional and economic environment.

Both in terms of governance and formalisation of investment objectives according to its appetite for risk, GFPG is facing major challenges in order to maintain its role model position in the world of Sovereign Wealth Funds.

[1] Source, Invesco Global Sovereign Asset Management Study 2018

[2] Statoil became Equinor in the summer of 2018.

[3] For illustration purposes, the annual report provides details of the remuneration of the institution’s main senior executives. See for example Government Pension Fund Global annual report 2018, Norges Bank Investment Management.

[4] An interesting discussion of the Fundamentals of GFPG’s asset allocation can be found in « The bond-equity allocation of the Norwegian Sovereign Wealth Fund », by Espen Henriksen, Knut Anton Mork, published by vox.eu in October 2016.

[5] See also the article « Les investisseurs institutionnels face aux externalités environnementales et sociales générées par les entreprises » published by Marie Brière in variances.eu in September 2018, which deals with the voting policy of the Norwegian Sovereign Wealth Fund.

[6] See the FT article of 28 May 2019: « The former head of the Norway wealth Fund attacks governance ».

- Merci ! - 30 octobre 2023

- Stratégie d’allocation d’actifs : couvrir ou ne pas couvrir le risque de change ? - 27 juillet 2023

- Investing with external managers – A report by Norges Bank Investment Management - 22 mai 2023

Commentaires récents