Posted first by The Atlantic Council, Apr. 1, 2021

A digital euro project will likely be launched in mid-2021, while the United States has not yet officially projected a digital dollar. Three main questions arise when looking at such a project: First, what is it? It is like “digital cash”, an electronic claim on the central bank, accessible to all. Second, why is it needed? Mainly to preserve the sovereign’s role in creating money and to enhance payment efficiency and financial inclusion in a digitized world. Third, how would it be designed? Some issues, including the extent of public-private partnerships or the reconciliation of privacy versus compliance, and the legal framework, remain to be solved.

In mid-2021, the president of the European Central Bank (ECB), Christine Lagarde, is expected to announce whether the ECB will launch a project to digitize the euro. I bet she will …cautiously, but presumably sooner than the United States Secretary of the Treasury, Janet Yellen, might for a digital dollar. Yet, in contrast to the relatively little interest her predecessor gave to such a project, Secretary Yellen has not rejected a recent call by the Atlantic Council to digitize the dollar. Meanwhile the US Federal Reserve is conducting preliminary research about it.

The ECB decision is likely to generate buzz around the possibility of central bank digital currency (CBDC), or “digital cash.” This type of attention tends to come with a lot of “fake news”. One can already imagine the headlines: “Cash is dead!” … False! “Better Bitcoin or Diem.” … No! “The electronic euro already exists; debit cards are the same!” … Wrong!

Thus, this educational summary on “what, why, and how a digital euro” focuses on use in retail (i.e. for the public), leaving aside a wholesale CBDC (reserved to interbank use,). The same is done in the ECB Report issued in October 2020, on which this summary builds.

1. WHAT?

A CBDC is like “digital cash,” a claim on the central bank (CB) that is as safe as banknotes, but electronic like scriptural payments via banks. It will add a new and safe means of payment as legal tender.

1.1. Offering an Electronic Claim on the Central Bank to the Public-at-Large

Physical cash is generally issued by the sovereign, as legal tender, and historically imposed as the way to pay taxes. Cash now takes the form of fiat money, based on the fundamentals of the economy, instead of being backed by other assets like gold. It is essentially composed of banknotes and, marginally, of coins. Yet, the private sector also issues money in a scriptural way. Banks can electronically transfer scriptural money (e.g., deposits) via cards, wires, etc. This privilege is granted to regulated institutions (e.g., banks), which therefore must be supervised. Both fiat and scriptural money domestically ensure the three functions of money: unit of account, means of exchange, and store of value (provided inflation remains low enough).

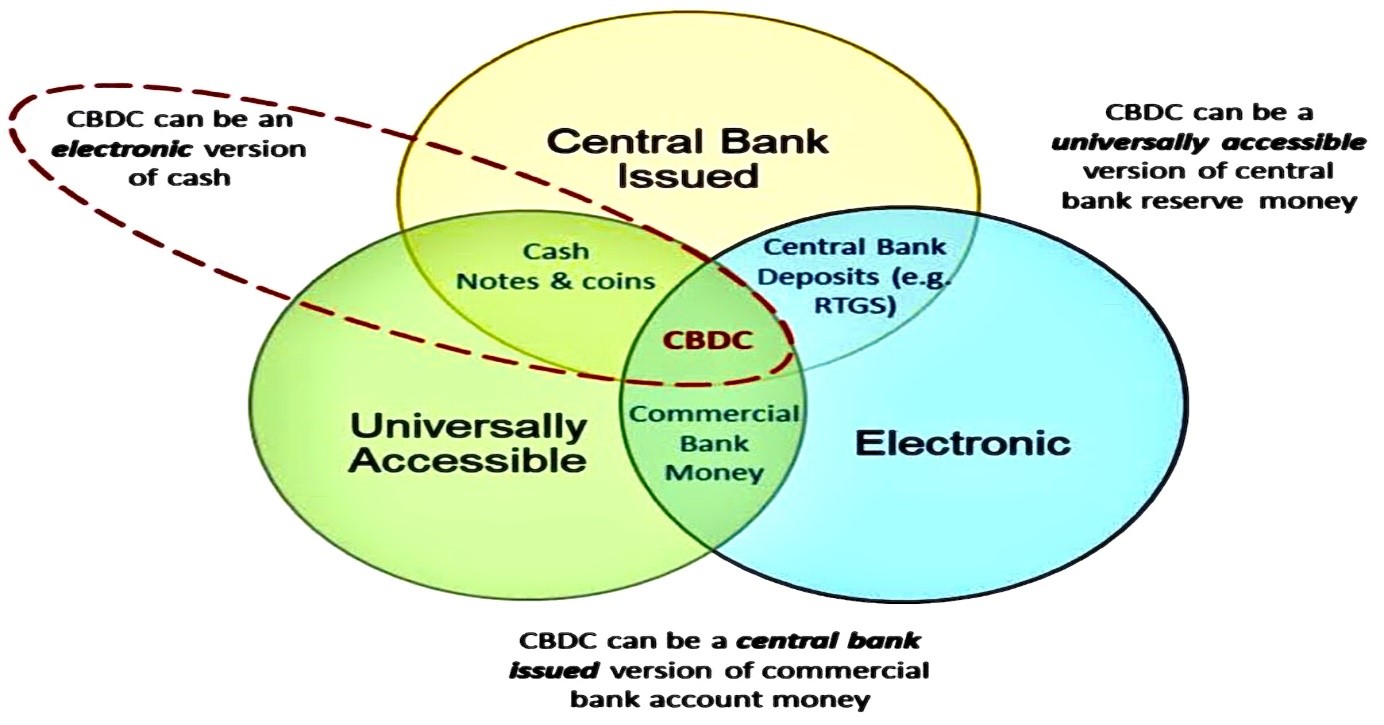

A CBDC altogether offers three attributes: 1) it is electronic, like transfers of scriptural money; 2) it represents a claim on the CB, like physical cash; but 3) it is universally accessible, i.e. to the public-at-large, in contrast to deposits by banks on their CB accounts (hence called “wholesale”). Thus, a CBDC is an electronic CB liability, universally accessible.

As such, a CBDC is at the heart of the “flower” drawn in Figure 1 (derived from BIS). Retail CBDCs are already being tested in some smaller economies, like the Bahamas, and piloted in several Chinese cities.

Figure 1: A CBDC is altogether an electronic and universally accessible claim on the central bank

1.2. Adding a New Payment Means Distinct from Stablecoins or Crypto Assets

CBDC differs from stablecoins and crypto assets. Stablecoins are electronic assets, issued by the private sector but indexed on, and convertible at, fixed rates on existing CB-issued currencies. The best-known example is Libra, first announced by Facebook in July 2019 as a basket of several international currencies. Facebook claimed that Libra would provide a tool to pay worldwide; yet retail remains largely domestic. Libra would also provide an alternative to slow cross-border payments; yet improving the latter would be better than replacing them. Actually, Facebook aims at competing with China’s big tech companies, like Tencent (partly supervised, notably by the Chinese CB) or Alibaba, whose head recently felt the limits of its room for maneuver. In December 2020, the revised project was renamed Diem, based on a single currency: Diem-dollar, Diem-euro. Yet, stablecoins pose risks for consumers and data protection (by creating a potential world oligopoly), as well as for financial stability more broadly (through supervision holes, possible runs, etc.). Risks to monetary policy are supposed to be limited by Diem, since Diem is based on the local currency; but risks would still arise if Diem-dollar, for instance, were to be used abroad instead of domestic currencies, like in the case of the dollarization of some developing economies.

Crypto assets are, by contrast, not based on existing currencies; their value is purely speculative on the assumption of their scarcity. The best-known example is Bitcoin, which has a maximum limit of twenty-one million units. Its birth around 2009 was falsely presented as a sign of distrust in central banks; actually, the demand for banknotes rose at that time. Furthermore, crypto assets are wrongly called “crypto currencies,” even if they may provide some functions of a currency. Indeed, their valuation exhibits a huge volatility, several times larger than that of the dollar or the euro. Thus, they can neither be a domestic store of value, nor even a unit of account. (To determine the value, one has to convert any price posted in Bitcoin into one’s own currency.) While Bitcoin is accepted as a means of payment in some circles, it is not legal tender and lacks liquidity. Worse, its scarcity and increasing cost of production limit its scalability, which is essential for any successful currency. For example, Bitcoin has a significant environmental cost: the energy consumption of one Bitcoin transaction is currently equivalent to 500,00 card transactions, which would grow if Bitcoin usage increased. Still, such speculative assets meet a demand and are becoming regulated, for example in the EU via its proposed MiCA (Markets in Crypto Assets).

2. WHY?

The main reasons why CBs may issue their own digital cash are to maintain control of the creation of money as a public good and to improve payments systems and financial inclusion in a digitized world.

2.1. Protecting the Sovereign Control of Money Creation (even if authorities rarely put this first)

When protecting the sovereign control of money creation, at least three broad types of factors may be at play: a declining use of physical cash for transactions, a resulting (or possibly causal) rise in private and foreign competitors, and potential policy advantages.

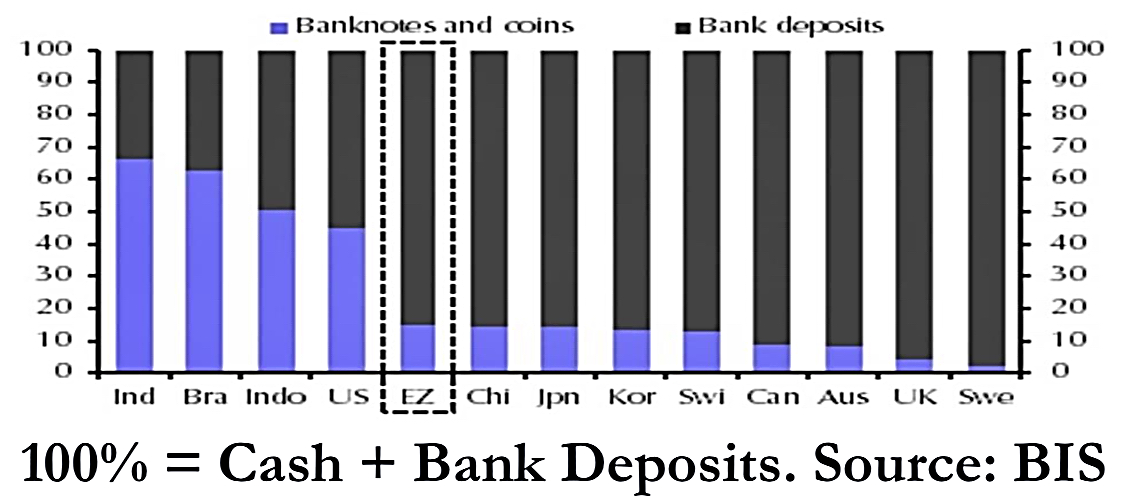

In the case of the euro area, a digital euro should be ready if cash transactions were to drop substantially or abruptly. While the share of issued cash is generally lower than that of bank deposits (its most liquid proxy), cash remains widely used for smaller transactions. As regards outstanding amounts, Table 1 shows lower shares of cash than deposits in Europe or former emerging market economies (EMEs), like China or Korea; this differs from less digitized EMEs, like India and Brazil, and from the US (with the dollar as a reserve currency).

Table 1: Shares of cash (banknotes and coins) versus banks deposits (Sources: BIS)

As regards transactions, banknotes include hi-tech security devices and still ensure the bulk of small ones. Yet, the use of banknotes for transacting is decreasing. Sweden is an extreme example, with a decision several years ago that payments in cash could be refused by shops. In the euro area, the latest ECB survey (dated 2019) showed that cash still represented 73 percent of the volume (i.e. number) of transactions and 48 percent of their value. This was nevertheless a 6 percent drop from 2016 both in volume and value. And the COVID-19 pandemic has surely boosted the rise of payments via cards, especially contactless; but the stock in the volume and value of banknotes, issued in 2020, increased across the world as a hoarding asset because cash remains the safest way to pay in case of emergency or even crisis. Thus, a digital euro would be a complement, not a substitute for cash, if only for specific users or circumstances.

A second factor relates to preserving money as a public good, partly issued by the sovereign, to face private and foreign competitors and integrate geopolitical challenges (although this is not always acknowledged as such). Cash is at the heart of the social contract legitimating the confidence put in money. True, the share of cash is marginal compared to the measures of quantity of money or liquidity; but markets move prices by affecting the margins. When regulating and supervising banks (whose loans create deposits), the sovereign ensures that extending the privilege to create money to banks remains safe. The sovereign shall now offer a domestic risk-free alternative to assets issued by entities not (yet fully) regulated and supervised. With ultra-low rates, seignorage is not at stake, but CBs care that banks are not destabilized by shadow private competitors. Geopolitical concerns may also play a role. Most digital big tech companies are not European–such as Facebook, whose Diem project still worries many in Europe. And the rise of similar companies in China and abroad may legitimize the recent US evolution towards issuing a digital dollar if its physical use were at risk.

Last, academics stress that a CBDC has the potential to increase policy efficiency–even if this is minimized by authorities. Two examples come to mind. The existence of banknotes, bearing zero interest, contributes to an effective lower bound for nominal interest rates. The latter is below zero, as seen in Europe since hoarding large and secured amounts of cash would be costly; but not that low (-75bp for key rates tested hitherto). A digital cash that bears a negative interest rate is conceivable even if it would create specific problems. Another theoretical example would be a fiscal stimulus to support consumption subsidized via digital cash which could elapse after a short period.

2.2. Improving Payments and Financial Inclusion in an Increasingly Digitized World

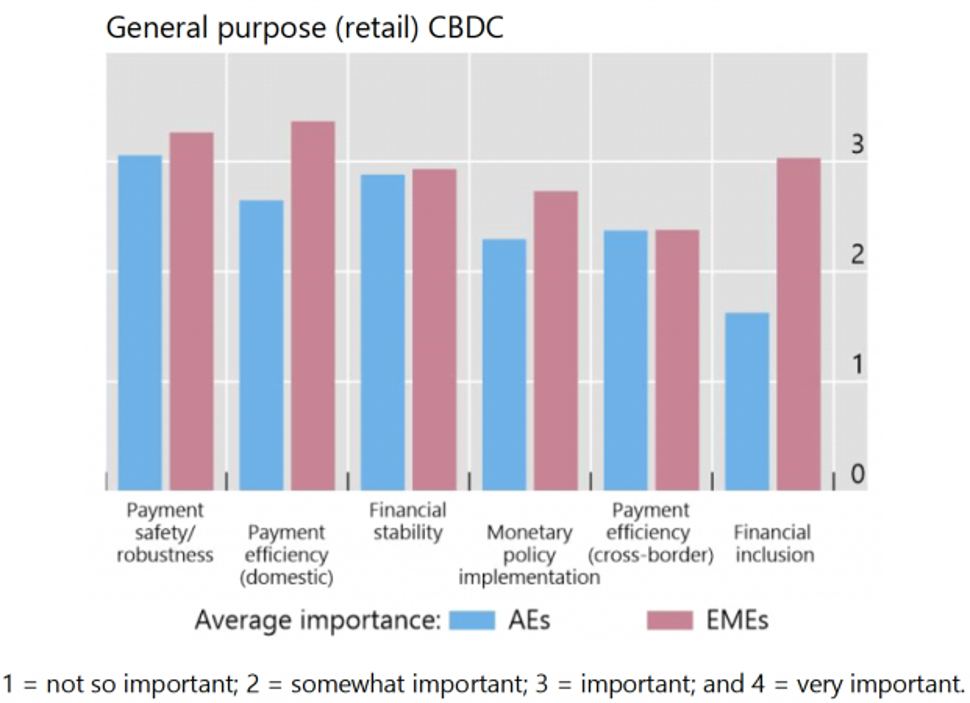

Better payments and more financial inclusion, or digitization, are quoted among the main rationale for shifting towards a retail CBDC. This is the expectation of the 2020 ECB report and the outcome of regular surveys by the Bank for International Settlements (BIS) (see Figure 2).

Figure 2: Drivers for Issuing a CBDC: Average Importance (Source: BIS working paper by Auer & al.)

Making payment systems more robust, safe, and efficient, including in cross-border transactions, matters especially for EMEs but also for advanced economies (AEs), like the US or the UK. In most euro member states, this seems less of a problem given progress already made or planned. Yet, Visa and Mastercard are being used within Europe even if they are foreign payment systems. The “European Payment Initiative” has recently been launched as a future substitute, in the same way as France domestically developed a national system “Carte Bleue.” Thus, beyond efficiency, sovereignty and independence may again play a role in promoting better means of payment.

Spurring financial inclusion matters more in EMEs than in AEs, even if the risk of digital exclusion shall also be avoided anywhere. A sudden problem to use physical cash could “exacerbate financial exclusion for the “unbanked” and for vulnerable groups in our society forcing the central bank to intervene” (2020 ECB Report). A digital euro may also contribute to enhancing European digitization and could even symbolically become an emblem of the ongoing process of European integration.

3. HOW?

Some major tradeoffs and the legal frameworks remain to be clarified in the euro area, as in the US.

3.1. Clarifying Some Major Tradeoffs

Major tradeoffs, still to be made for any retail CBDC, include the extent of any public-private partnership, the nexus of compliance versus privacy, and the mix of interoperability versus proprietary features. As other CBs, the ECB enjoys the opportunity to assess and test various options provided by private competitors before selecting the best one(s). Figure 3 is borrowed from Auer & al. and shows the variety of choices at different stages.

Figure 3: CBDC Pyramid distinguishing architecture, infrastructure, accessibility and interoperability

The CBDC pyramid maps consumer needs onto the associated design choices for the central bank. The left-hand side of the CBDC pyramid sets out the consumer needs and associated features that would make a CBDC useful. The pyramid’s right-hand side lays out the associated trade-off – forming a hierarchy in which the lower layers represent design choices that feed into subsequent, higher-level decisions. Source: Auer and Böhme (2020)

The architecture (basis of the pyramid) offers one aspect of the public-private partnership. Like most CBs, the ECB will surely opt for a hybrid or intermediated solution. It will not merely back the private sector (indirect option), which seems closer to the current Chinese tests as clarified by a former governor of the Chinese central bank. Nor will the ECB do everything (direct option): this would mean consumers’ accounts on its balance sheet, with all the related burden, including to Know Your Customer (KYC), which is at the root of the trust in extending the privilege to create money. Indeed, the ECB states in its 2020 Report: “Supervised private intermediaries would be best placed to provide ancillary, user-facing services and to build new business models on its core back-end functionality. A model whereby access to the digital euro is intermediated by the private sector is thus preferable.”

The infrastructure (yellow layer) focuses on the choice between a distributed ledger technology (DLT) and a centralized platform. Most CBs are officially agnostic, even if some spot the impossible trinity for retail of security, scalability and decentralization. Accessibility (green) includes the key need to reconcile privacy and compliance with relevant legislation (cf. money laundering and financing of terrorism, e.g. via digital identity or tracing transactions). A bearer digital euro, also called “token-based” (or “value-based”) could ensure more anonymity, but would surely be limited in amount. This applies to banknotes, which are tokens accessed by the public at large via an ATM and a banking account. In any case, CBs do not want a CBDC to destabilize the banking sector by attracting too much liquidity.

Last, the tip of the pyramid (in blue) regards the mix of proprietary features, decided by each CB, and interoperability; the latter is necessary to link any digital cash both domestically to other means of payment and externally to complete cross-border operations. The same applies currently to banknotes with common world standards but specific domestic features.

3.2. Defining the Legal Frameworks

Most of the CB statutes and monetary laws across the world were (re)written well after cash became based on fiat money and refer explicitly to banknotes. Thus, before adopting digital cash, a number of important legal considerations related to digital currencies must be addressed. They include: the legal basis for issuance, the legal implications of different design features, and the applicability of the currency-area legislation to the CB as issuer.

Without going here into legal details, “EU primary law does not exclude the possibility of issuing digital euro as legal tender, which would consequently require payees to accept it for payments” (2020 ECB Report). A combination of specific articles of the Treaty on the Functioning of the European Union (TFEU) and the Statutes of the European System of CBs (ESCB) would allow this: for example, TFEU Art. 128 with Art. 16 of the ESCB Statute would be the easiest legal basis for a digital euro. Since any CBDC launching should not damage the CB reputation, technical issues–such as offline transactions, or cyber risks (better mitigated by CB involvement)–are still to be solved and will affect the timeline. The latter may be 4 years as stated by the ECB President Lagarde early April 2021.

* * *

The need for CBs to accelerate the process is clear, especially in partnership with the private sector. From crypto assets or stable coins to the project of a digital euro, the general principle seems to apply again and again: The private sector initiates, the public sector regulates and/or appropriates. Any further conclusion shall be subject to financial innovation and the tokenization of the economy

Mots-clés : digital euro – central bank – CDBC – stablecoin – crypto-assets – payments – money

- The current Polycrisis versus the Global Financial Crisis - 16 octobre 2023

- Un euro numérique pour tous : c’est quoi, pourquoi, comment - 14 mai 2021

- A Digital Euro: What, Why, and How? - 22 avril 2021

Et le crédit social comme en Chine ensuite ?

This is the most useless, costly and environnementally detrimental idea ever dreamt by our politicians. For your info, the latest news is that Tesla no longer accept cryptos to supposedly « limit pollution »….