The Financial Times in 2018 writes “Where are all the female economists?”, a legitimate question considering a cross-country evidence of the underrepresentation of women as careers in economics advance. In the US, the share of female full and associate professors has been hovering around 13% and 23%, respectively (Lundberg and Stearns, 2018). In European institutions these numbers are slightly better, 22% and 32.5%, respectively (Auriol, Friebel and Wilhel, 2019). In this front, the economics profession seems to be left behind relative both to the overall population and to other academic disciplines including the sciences and mathematics (see Bayer and Rose, 2016 and Lundberg and Stearns, 2018 among others). Strikingly, in contrast to other academic disciplines, this promotion gap in economics cannot be fully explained by differences in productivity between men and women or family characteristics (Ginther and Kahn, 2014).

Central bank governance is highly masculine

The underrepresentation of women is also present in decision-making institutions, like central banks. In 2019, only 14 out of 173 central banks are headed by a woman (i.e. 8%). Janet Yellen was, until the beginning of 2018, the Federal Reserve’s first and only female leader in over 100 years. Meanwhile, for the first time in its history, starting in November 2019 the European Central Bank (ECB) will likely be headed by a woman, Christine Lagarde. Nonetheless, the new ECB President-elect will be deciding monetary policy in a male-dominated Governing Council (GC). The ECB’s GC is currently made of governors of 19 euro area countries (all men) and 5 other members of the Executive Board (only one women, Sabine Lautenschläger), raising to only 8% the share of women deciding on the euro area monetary policy.

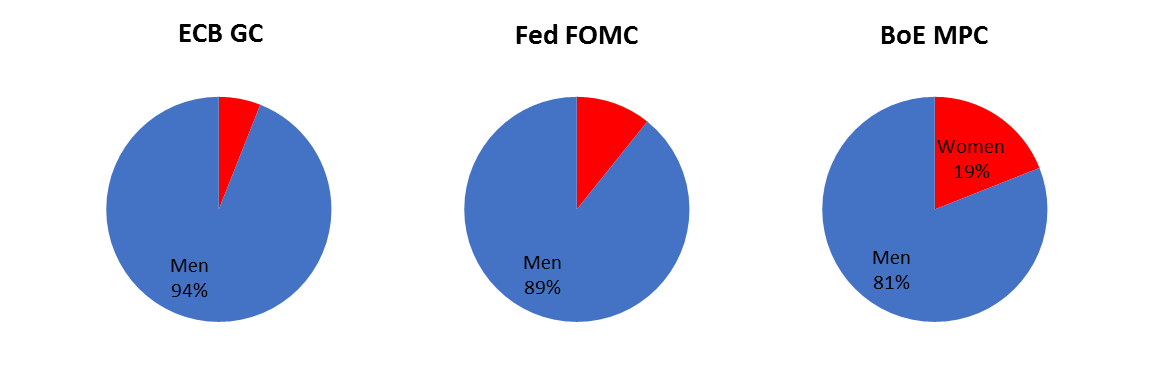

The share of women in central bank governance does not improve if we look at historical records. Focusing on two other major central banks taking monetary policy decisions through committees – the Federal Reserve and the Bank of England -, we observe that they have similar shares. For instance, out of 130 members that have served on the Fed’s FOMC in the last 55 years (1960-2015), there have been only 14 women (slightly over 10%). The Bank of England does slightly better, as 19% of MPC members have been women since its creation in 1997 (see Figure 1). Furthermore, as discussed in Istrefi and Sestieri (2018), a broader definition of central bank governance, including all central banks’ decision-making bodies, such as general and governing councils or boards of directors, raises the share of women to only 20% in the European Union. This share has been fairly constant over the past 15 years.

Figure 1. Women are poorly represented in monetary policy decision committees

Note: GC, the Governing Council of the ECB (1998-2018), FOMC, the Federal Open Market Committee of the Fed (1960-2015), MPC, the Monetary Policy Committee of the BoE (1997-2018). Source: Istrefi and Sestieri (2018).

Does gender diversity matter for monetary policy?

The mere existence (and success) of monetary policy committees in central banks is because they pool knowledge and bring a diversity of views and perspectives to the table. Thus, doubling the pool of talents would be highly beneficial to decision making. But beyond fairness and efficiency, would a gender-balanced committee matter for the direction of monetary policy? Do women have a different approach to policy than men, for instance do women tend to assign more priority to fighting inflation or to supporting more output growth and employment?

Some clues come from the case of the FOMC of the Federal Reserve, using insights from a unique dataset described in Istrefi (2019) that divides FOMC members into three types of policymakers: inflation-fighting hawks, growth-promoting doves and swingers, i.e. those members who are perceived to have switched from one type to another. The terms of this classification are based on the language that Fed Watchers, financial analysts or monetary policy commentators generally use to portray central bankers. Istrefi (2019)’s measure of hawks, doves and swingers is based on a textual analysis of 20,000 articles in US newspapers since the 1960s, investigating how Fed policymakers are portrayed in terms of their policy leanings towards inflation and growth. Looking at 130 FOMC members, Istrefi (2019) shows that 39% of them are perceived as all-time hawks, 30% as doves and 24% as swingers while the rest remained unknown. In terms of gender, women (14 out of 130 members) are perceived more on the dovish side than men (57% versus 27%).

Does this mean women in the FOMC are intrinsically more dovish than men? Not necessarily. First, the sample of women is too small to assign statistical significance to these numbers. Second, a subsequent study using this classification (Bordo and Istrefi, 2018), highlights two important factors in moulding the policy preferences of these FOMC members: ideology and events that shaped their lives before joining the FOMC. They show that the odds of being a dove are higher for those that studied in universities with Keynesian beliefs, like Harvard or Yale, and were appointed to their position, mainly to the Board of Governors, by Democratic Presidents. This is equally true for men and women in the FOMC. Moreover, the majority of women in the FOMC (11 of 14 of them) started their tenure from the 1990s onwards, which is a period characterised by a dovish trend in male FOMC members as well. Besides, hawkish-perceived women and swingers have all but one represented regional Federal Reserve Banks. Interestingly, half of them have represented the Cleveland Fed, known for a high inflation-fighting appetite.

Thus, gender doesn’t seem to be a relevant indicator of policy orientation. When guessing FOMC members’ orientations, (Bordo and Istrefi, 2018) show that it is more informative to know from which university these members graduated, what great economic events shaped their early life, or who appointed them and for what position, rather than their gender.

In 2014, Janet Yellen, (former Federal Reserve Chair) gave the following remarks at the Fed’s National Summit on Diversity in the Economics Profession welcoming address: “there has been a fair amount of public debate in recent years about the health of the economics profession, prompted in part by the failure of many economists to comprehend the dire threats and foresee the damage of the financial crisis. [….] Did the economics profession recruit and promote the individuals best able to bring the energy, the fresh insights, and the renewal that every field and every body of knowledge needs to remain healthy?” Numbers cited above do not suggest so. Therefore, more diversity, be it related to gender or minorities, is a worthy goal to pursue, to enlarge the pool of best people and the best ideas in decision-making.

Mots-clés : central bank governance – gender diversity – monetary policy

- Gender diversity, central banks and monetary policy - 2 octobre 2019

Commentaires récents